Comparing Companies' Coverage of ESG Issues Across Corporate Reports

[Benchmark module]

The Benchmark module lets you compare your company’s ESG disclosures with peers and industry-specific companies. The comparison is based on corporate reports from the world’s largest market-cap companies, including:

-

Annual financial reports

-

Integrated reports

-

Annual sustainability reports

-

10-K SEC filings

Creating your benchmark analysis

-

Go to the Benchmark module.

-

If this is your first time, click Get started. Otherwise, click Create new in the menu next to an analysis name.

-

Name your analysis.

-

Select the corporate reports to include.

-

Select the countries and industries to include.

-

Select the companies to include. (You can benchmark using both countries/industries and selected companies.)

-

Click Save and run analysis to generate your results.

Reading the results

-

A chart will show your company’s emphasis score alongside the number of companies that place different levels of emphasis (High, Medium, Low, or No Mention) on ESG topics.

-

Topics are ranked by the average level of emphasis in the corporate reports of the selected companies.

-

Gradient colors in the bars represent emphasis levels. Hover over any section to see the number of companies in each category.

-

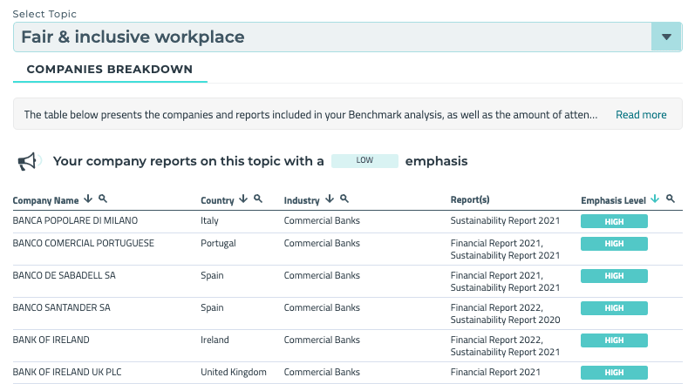

Click on a topic to view a detailed list of the companies and reports, along with the level of emphasis each places on that topic.

-

Click on a company and analysis to explore specific mentions within the selected report. Use the arrows in the bottom-right corner to browse through them.

Note: Each time the Benchmark page is loaded or refreshed, the data in your analysis is updated.

Use cases

The Benchmark module helps you:

-

Understand your position – see how your disclosures compare with peers and industry leaders.

-

Identify disclosure gaps – uncover where your company places less emphasis than the market.

-

Track industry practices – monitor how ESG topics are addressed across corporate reports.

-

Strengthen reporting – use peer insights to enhance the relevance and completeness of your own disclosures.